Inside Transactor Dynamics

Over the past year, insider transactions for CVS Health Corporation (NYSE: CVS) have revealed significant buying and selling activities. These transactions provide valuable insights into the alignment between leadership and other shareholders, as well as potential risks to the company’s value.

Insider Transactions Over The Last Year

The analysis of CVS Health insider transactions reveals a few notable patterns. Insiders generally exhibit a preference for purchasing shares over selling them, indicating a bullish sentiment. However, there are instances where selling pressures can signal concerns about the stock’s future trajectory.

The Largest Insider Sale

Among the transactions analyzed, the sale of 2.3 million shares by Executive VP & Group President Prem Shah stands out as the most significant insider transaction over the past year. This sale occurred at an average price of $76.95 per share, well above the current market price of approximately $48.01. The timing and volume of this sale have raised questions about the confidence Prem Shah has in the current stock price.

Insiders Who Sold

Surprisingly, only Prem Shah was identified as an insider seller over the past year. His actions suggest a potential disconnect between his personal financial interests and the broader market sentiment.

Insider Purchases

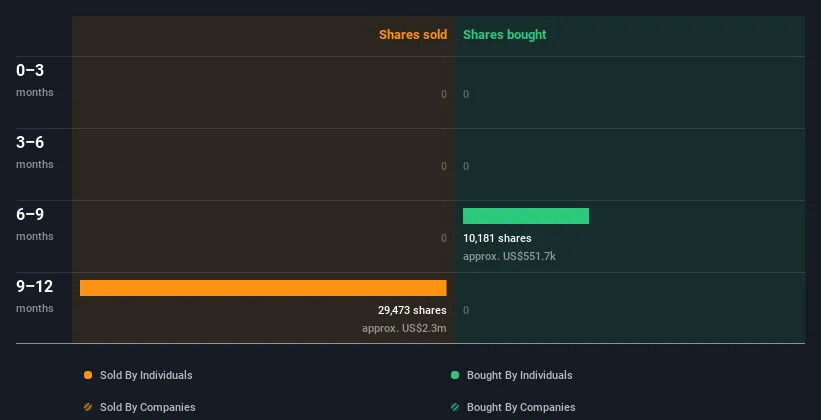

In contrast to the selling activity, CVS Health insiders purchased 10,185 shares worth $554,000 during the same period. However, they also divested 29,470 shares valued at $2.3 million, highlighting a net insider selling volume of 19,285 shares for $1.7 million.

Visual Depiction of Insider Transactions

For a visual representation of insider transactions over the past year, refer to the graph below:

NYSE: CVS Insider Trading Volume (January 12th, 2025)

Clicking on the graph will provide detailed insights into who traded, how much they traded for, and when their trades occurred.

The Importance of Insider Transactions

While insider transactions can offer valuable information about market sentiment, they should be analyzed in conjunction with other factors such as financial performance and macroeconomic conditions. Investors are encouraged to monitor these activities closely as they may provide clues about management confidence and potential risks.

Insider Ownership: Alignment Between Leadership and Shareholders

Insider ownership is another critical factor that reflects the alignment between leadership and other shareholders. For CVS Health, 0.09% of the company’s shares are owned by insiders, a figure that raises questions about the level of control exerted by leadership on ordinary shareholders. This percentage indicates a low level of insider influence, which may or may not align with broader investor interests.

The relatively small ownership stake suggests that management retains significant control over the company, potentially impacting decision-making processes and share distribution. Investors are encouraged to assess how this alignment affects overall corporate strategy and financial stability.

What Does This Data Suggest?

-

Insider Selling: A Cautionary Signal

The substantial insider selling by Prem Shah could indicate growing concerns among leadership about the company’s future prospects. While such actions may reflect short-term market sentiment, they can also signal a lack of confidence in broader market conditions or competitive landscapes. -

Net Insider Activity: A Mixed Picture

Despite the significant selling activity, there is a net insider purchase of 19,285 shares over the past year. This mixed trend suggests that while leadership may have some confidence in the stock price, they are also taking calculated risks by diversifying their positions. -

The 3 Warning Signs

- Market Sentiment: The scale of selling activity raises questions about market sentiment and potential headwinds to the company’s growth.

- Financial Performance: Insiders’ actions may reflect concerns about earnings or revenue trends, which could impact future profitability.

- Company Structure: The ownership stakes held by insiders suggest a degree of control that may not align with broader investor interests, potentially leading to conflicts of interest.

-

Implications for Investors

While insider transactions can provide valuable insights, they should be part of a broader investment analysis rather than the sole determinant of decision-making. Investors are encouraged to consider factors such as financial performance, macroeconomic trends, and competitive dynamics in their evaluation of CVS Health’s potential.

The Role of Insider Transactions in Market Sentiment

Insider transactions serve as a gauge of market sentiment among executives. While purchasing activity reflects confidence in the company’s future, selling activity may indicate uncertainty or negative outlooks. Understanding these patterns can help investors gauge leadership sentiment and make informed decisions.

In conclusion, CVS Health’s insider transactions over the past year highlight both optimism and caution within the ranks of leadership. By analyzing these activities alongside other financial metrics, investors can gain a more comprehensive understanding of the company’s trajectory and potential risks.

This analysis provides a detailed overview of CVS Health’s recent insider transactions and their implications for investors.